Below are some of the meeting highlights from this year’s delegation trip.

-

Franklin Templeton ranks among the world’s largest asset managers, overseeing $1.4 trillion in assets under management (AUM). Jenny Johnson is the third-generation of the family to lead the business.

-

Jenny Johnson highlighted Franklin Templeton’s commitment to continuous technological innovation. Despite initial concerns about automation, such as the potential job displacement of roles like financial advisers during the internet’s early days, unforeseen opportunities and industries have arisen, underscoring the essential role of human ingenuity. Innovations like the iPhone have generated unexpected businesses and job prospects that were not initially anticipated.

-

Jenny Johnson provided her insights into the American IRA policy, emphasizing that investments in new energy sources in the United States should take into account not just short-term policy incentives but also long-term commercial viability. On the whole, she maintains that the United States is well-equipped to accomplish various objectives within the field of energy transition.

-

When asked about how to excel as the CEO of a large organization, Jenny Johnson believes in focusing on the 4Ps: People, Passion, Purpose, and Persistence. She emphasized the importance of surrounding yourself with exceptional individuals, having a genuine passion for what you do, and aligning your work with a clear purpose. At Franklin Templeton, they define their purpose as helping people achieve significant financial milestones in their lives, and Johnson underscores the significance of presenting your work in a purposeful manner that inspires others to follow. She also underscores the value of embracing uncertainty and confronting the challenges that inevitably arise.

-

George shared his latest insights on global geopolitics and also discussed his views on energy transition. He acknowledged that energy transition is a global trend, with the UK and the European Union having legislation in place to phase out carbon technologies. However, funding for these transitions often comes from consumer levies or government taxes, which can be a burden on individual citizens, leading to delays or extended timelines for implementing green policies in many regions due to economic challenges.

-

George noted that Europe faces increasing challenges in engaging with China, particularly in areas related to national security. Nevertheless, he emphasized the significant opportunities for Chinese companies to expand their presence in Europe across various other sectors.

-

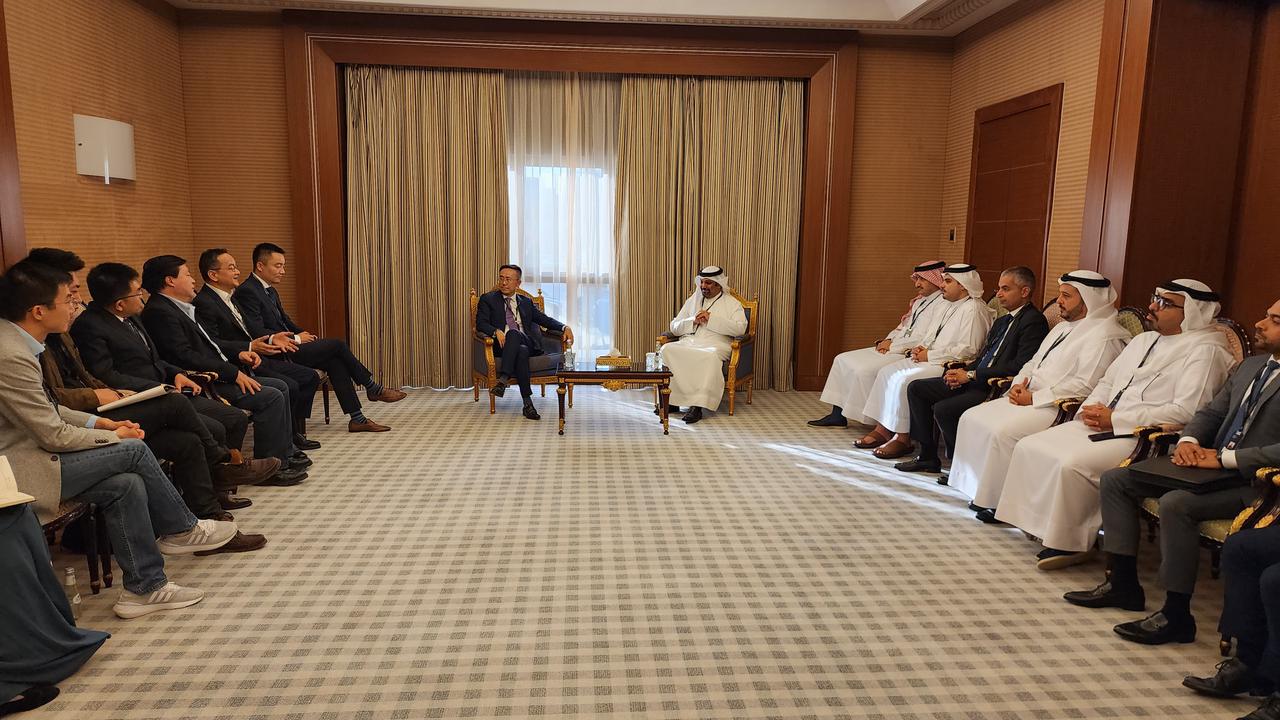

The delegation received a warm welcome from a distinguished assembly of Bahraini representatives, including H.E. Shaikh Salman bin Khalifa Al Khalifa, Minister of Finance and National Economy and Chairman of Mumtalakat, sovereign wealth fund of Bahrain; H.E. Shaikh Abdulla bin Khalifa Al Khalifa, CEO of Mumtalakat; H.E. Shaikh Ali bin Abdulrahman bin Ali Al Khalifa, Ambassador of the Kingdom of Bahrain in Riyadh, KSA; H.E. Khalid Humaidan, Chief Executive of Bahrain Economic Development Board and has recently been appointed the next governor of the Bahrain Central Bank; Shaikh Fahad Al Khalifa, advisor to His Royal Highness the Crown Prince and Prime Minister’s Office; and CEO of Bahrain’s Future Generations Fund.

-

Bahrain’s Minister of Finance has a vision for Bahrain to ascend as a regional hub comparable to Singapore. The nation’s primary emphasis encompasses six key sectors: banking, tourism, manufacturing, logistics, telecommunications, and natural gas. He actively encourages more Chinese businesses to establish their presence in Bahrain.

-

Nicolas Aguzin highlighted his primary objective: the creation of an international market in Hong Kong that amalgamates the strengths of global financial centers such as New York and Shanghai, with a strong emphasis on stability and unique offerings. He underscored the pivotal role of enticing international companies to list in Hong Kong and the essential importance of attracting investors to make this vision a reality.

-

The delegation met a group of senior representatives from Aramco, including Ahmad O. Al-Khowaiter, Executive Vice President and Chief Technology Officer; Mahdi Aladel, CEO of Aramco Ventures, the corporate venturing arm of Saudi Aramco; and other representatives from Aramco and Prosperity7 Ventures.

-

The primary focus of the discussion revolved around investment and cooperation opportunities in the clean energy sector and fields like robotics.

The ADGM hosted the M31 delegation on the closing day of its 6-day trip in the Middle East. Among those in attendance were Bharath Shivappa, Executive Vice President at ADGM; Ayesha Al Helli, International Operations Officer (China) at Abu Dhabi Investment Office; Joe Chamoun, Head of Partnerships at Abu Dhabi Residents Office; Gabriel Cotellessa, Head of Investments at Abu Dhabi IPO; and representatives from Hub71, Abu Dhabi’s unique global tech ecosystem.